Royal Caribbean’s Virtual Mastercard & App

How to better the best agent reseller program in the industry?

Club Royal members generated £111 million in cruise fares in 2019 compared to £80 million for non-rewards members. That’s a staggering £31 million difference. We launched the program in 2015 and constantly innovate to keep Royal Caribbean ahead of the competition.

Value We Created

Being the second largest cruise company in the world is no mean feat and staying ahead of the competition is tough. The Club Royal rewards program has gone from strength to strength since 2015 and covers a wide range of activity. From car giveaways and games to online rewards, escape rooms and prepaid Mastercards for members to turn points into money.

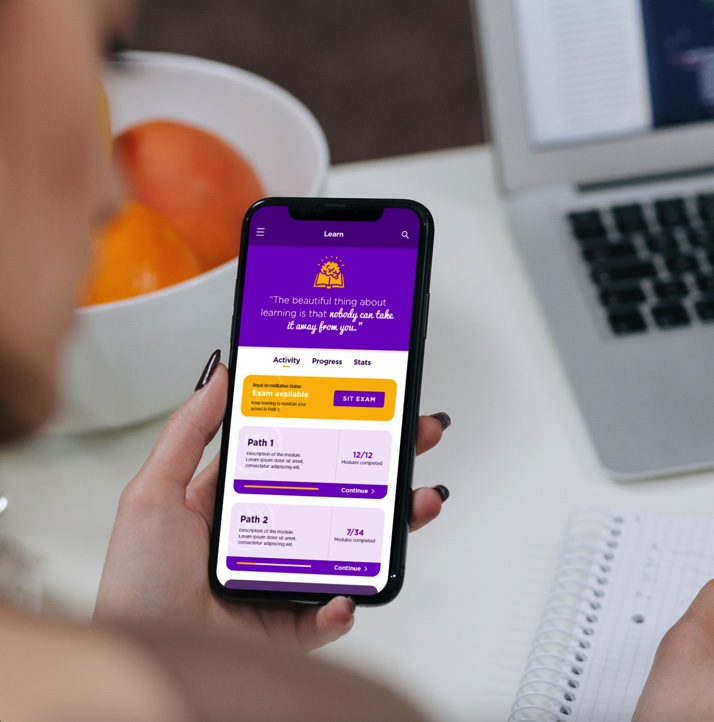

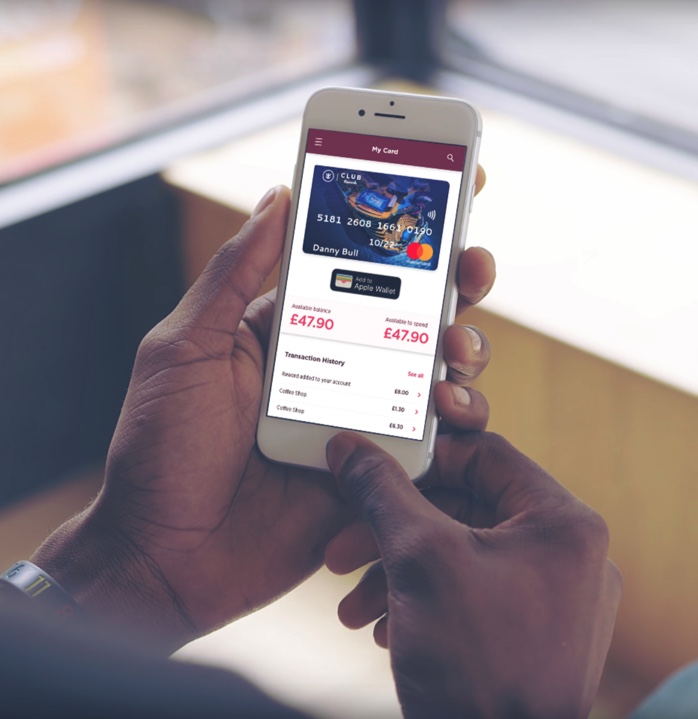

We took Club Royal to the next level with digital innovation, creating a first in the industry – a completely virtual prepaid card managed entirely through a bespoke mobile app. Members can now add a virtual card to their Apple or Android phone’s wallet and spend hard-earned rewards using mobile pay technology.

Oh, and we also did away with plastic in the process, making it a world-first initiative for this industry leader who put sustainability front of mind.

The Problem We Solved

The challenge was simple: create the next step in an evolution of the rewards program to keep Royal Caribbean ahead of the competition for the next 5 years. The end result was anything but.

Working with partners at Apple, Google and Mastercard we created a solution that phased out expensive plastic and moved thousands of travel agents to virtual cards. All while maintaining business as usual earning and historical data. The result is a simple to use and beautifully designed on-brand app.

How We Did It?

The 3 pillars of our digital transformation solution were:

- Building an excellent UX

- Mastering complex API integrations

- Seamlessly working across our inter-agency teams in the CI Group to access a wide range of complimentary skills.

Without this diversity and experience none of this would have been possible.

The newly created, cross-platform mobile application communicates with our existing rewards database to onboard users. A range of APIs we created integrate with financial systems architecture from Mastercard, Apple and Google to handle the complexity of getting virtual cards into users’ wallets. The result is a perfect journey from plastic wallet, to virtual wallet, to happy customer!